Plotio

Finance

【Morning session】Four Day Tariff Negotiations Gold Narrows Range Awaiting Catalyst

Gold:

Both parties in the tariff talks have announced a detailed meeting schedule spanning four days—longer than the duration of the previous four rounds of talks. The negotiations will start this Friday and end next Monday, with all sessions falling on trading days.

Trump stated, “I think our talks will go very well, and everyone will be happy.” In the hour following this announcement, the market showed little movement. Yesterday, gold prices saw a cliff-like drop; over the past three days, the volatility of the gold market has plummeted from a peak of $300 to approximately $89. Currently, market volatility has decreased, and the pace of price convergence is rather unusual.

Mai Dong, an investment strategist at Zhisheng Research(exclusively invited by Plotio), opined that tonight, the U.S. will release September CPI data—a rare economic indicator available during the government shutdown. It remains uncertain whether this data will trigger greater volatility in gold prices.

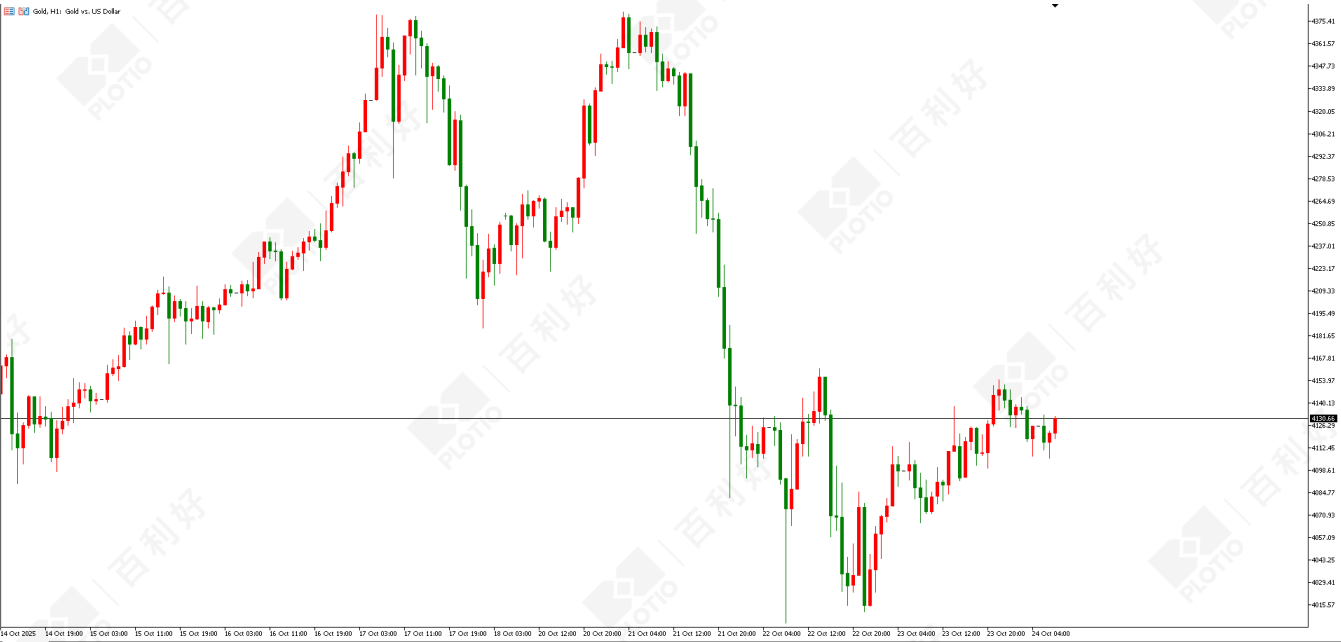

Technical Analysis:On the daily chart, a bullish candle was closed.On the 1-hour timeframe, the market is currently consolidating in the $4,010–$4,150 range, with the downtrend slowing down. Focus on the resistance from the 120-day moving average. For today, pay attention to the support level at $4,050 below and the resistance level at $4,150 above.

Gold hourly chart

Gold hourly chart

Crude Oil:

Crude oil prices rose strongly after the U.S. announced sanctions on Russia’s two largest oil producers. The market has increased pricing for short-term supply tightening.

According to the U.S. statement, the sanctioned entities include Rosneft and Lukoil—together, the two companies account for nearly half of Russia’s crude oil exports overseas. If the sanctions are enforced more extensively, global crude oil supply will be disrupted, particularly in European and Asian markets.

Trump has pressured Asian countries and India to reduce purchases of Russian oil, further cutting Russia’s oil revenue to push the Russia-Ukraine conflict toward the negotiation stage.

At the same time, the U.S. stated that it will directly discuss the flow of Russian crude oil with Asian countries during a meeting to be held in South Korea next week. Europe is also tightening policies in tandem, with new sanctions soon to be implemented.

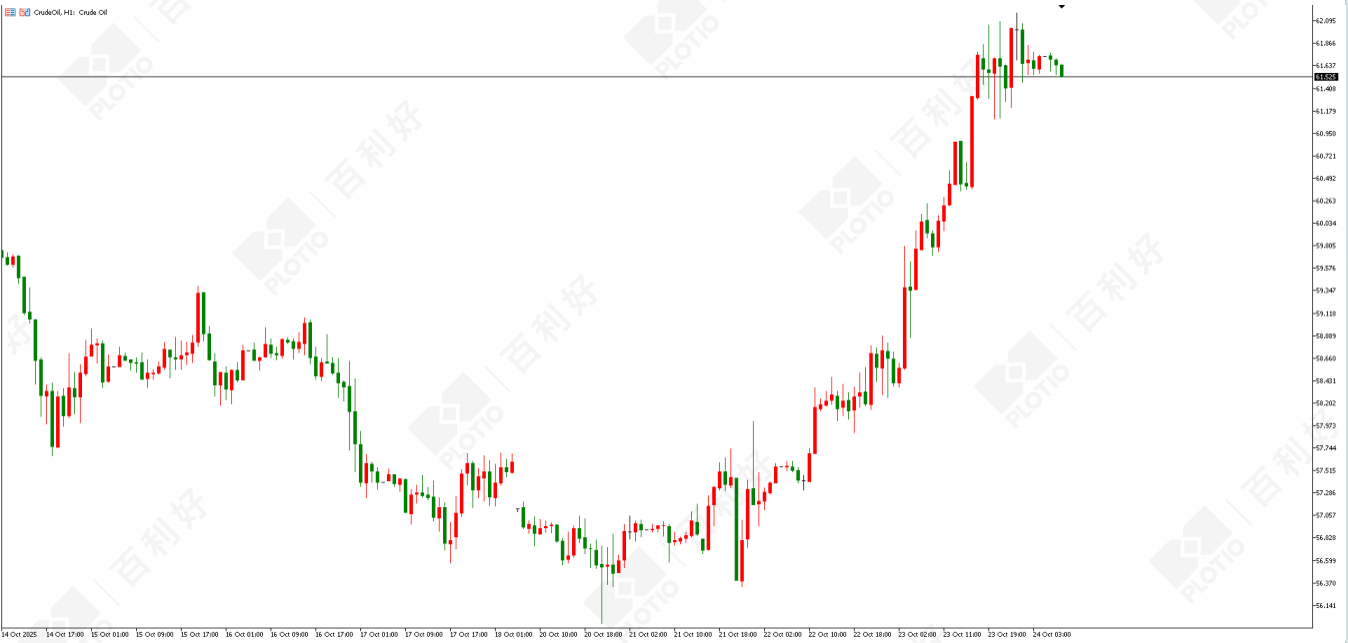

Technical Analysis:On the daily chart, a bullish candle was closed, with prices rising strongly.On the 1-hour timeframe, the uptrend continues. From the MACD perspective, bulls hold the advantage, and prices will rise further. Focus on the support level around $60.80 below and the resistance level around $63.20 above.

Crude oil hourly chart

Crude oil hourly chart

Copper:

On the daily chart, a bullish candle was closed, and the market remains in a consolidation range of $4.76–$5.10.

On the 1-hour timeframe, prices have broken upward out of the $4.83–$5.01 oscillation range, and the market continues to rise toward $5.10. Focus on whether prices can stabilize above $5.10 today.

NASDAQ:

On the daily chart, a bullish candle was closed, and prices remain in high-level consolidation. Recently, the market has been largely influenced by Trump’s remarks, with an unclear trend.

From the 1-hour perspective, prices found support near the trendline but encountered resistance when moving up to recent highs. Intraday focus is on the support level at 24,950 below and the resistance level at 25,200 above.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live