Plotio

Finance

【Morning Session】 Risk aversion sentiment fades Gold in mid-term adjustment

Gold:

Overnight, gold fell below the crucial $4,000 mark, with the mid-term correction still in progress. However, it cannot be concluded that the uptrend has come to an end.

The direct cause of the recent gold correction is the imminent resolution of U.S. tariff issues. U.S. Treasury Secretary Janet Yellen stated that both sides have reached a very substantive framework agreement, and the U.S. will no longer consider imposing a 100% tariff on China. This directly led to a decline in market risk aversion and the sell-off of safe-haven assets.

Nevertheless, market reactions indicate strong buying interest. The Bank of Korea is considering increasing its gold reserves for the first time in more than a decade, which may mark the start of a new round of gold-purchasing spree by global central banks and is of great significance.

Peng Cheng, Market Strategist at Zhisheng Research(exclusively invited by Plotio), believes that the current situation only reflects the easing of risk aversion, while the U.S. dollar crisis has not ended. Gold remains a crucial component in asset allocation.

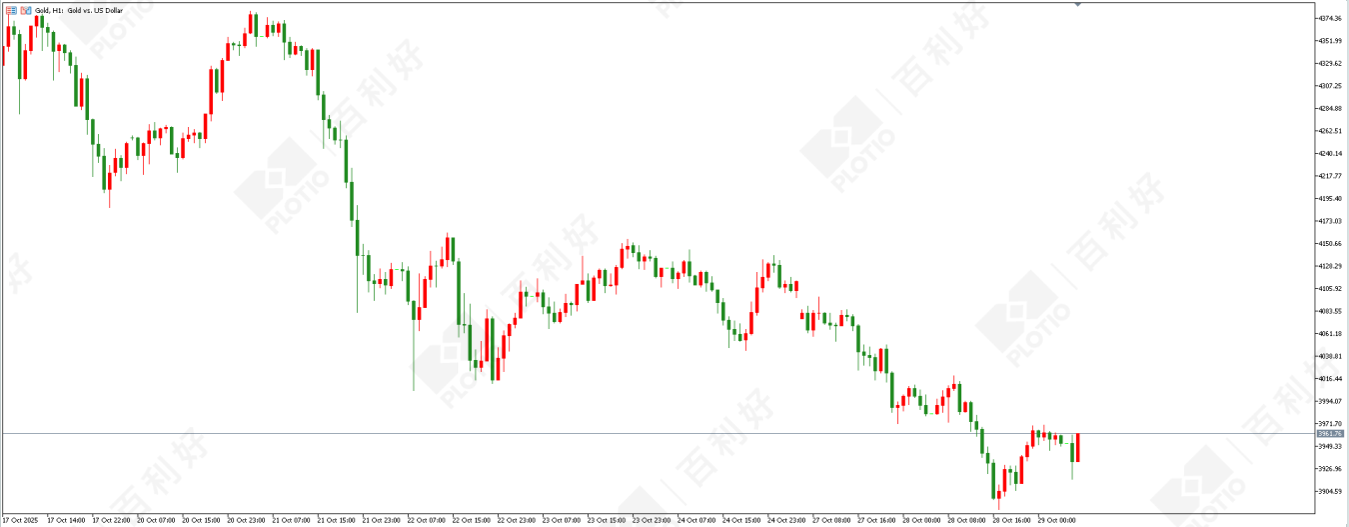

Technical Analysis: Gold closed with a small bearish candlestick featuring a long lower shadow on the daily chart, indicating weak counterattack momentum from the bulls. The downward structure on the 4-hour chart may be coming to an end, suggesting a potential intraday rebound. Focus should be on the resistance level around $4,010.

Gold hourly chart

Gold hourly chart

Crude Oil:

Overnight, crude oil prices dropped significantly, showing signs that the previous rebound momentum may have ended. This also reflects the weakness of oil prices, as fundamentals have severely limited the room for a rebound.

The easing of tariff issues has alleviated concerns about demand contraction caused by prolonged economic conflicts. However, if there is no significant improvement on the consumer side, the supply-demand imbalance will remain prominent. The continued production increase by OPEC+ will exacerbate the problem of oversupply.

The joint production increase by OPEC+ and non-OPEC countries has prompted top global crude oil traders such as Gunvor, Vitol, and Trafigura to warn of a short-term drop in oil prices, with a general consensus that crude oil is facing oversupply. The forward curve, used by traders to gauge market strength, also shows a bearish outlook for the U.S. crude oil market next year.

The International Energy Agency (IEA) stated that the daily crude oil surplus in 2026 will be approximately 4 million barrels, 18% higher than the forecast a month ago. Meanwhile, consumption in major consumer countries is cooling down, which may worsen the imbalance.

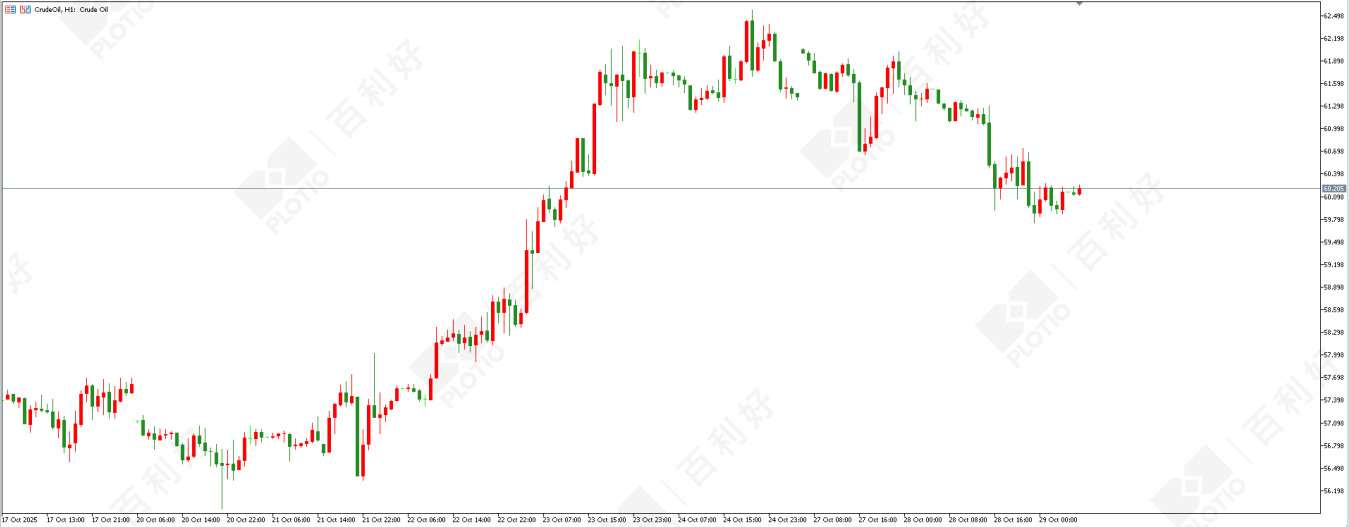

Technical Analysis: Crude oil closed with a large bearish candlestick on the daily chart, with obvious resistance from upper pressure levels. The long-term moving average support on the 4-hour chart remains effective, suggesting a potential intraday rebound. If it stabilizes above the $61.50 level, it may challenge $63.

Crude oil hourly chart

Crude oil hourly chart

Copper:

Copper closed with a small bearish candlestick on the daily chart, but the price remains at a high level, forming an upward breakout pattern. It is highly likely to hit a new high in the mid-term. On the 1-hour chart, the price center of gravity has started to shift upward, and the small-scale structure may be completed, indicating a potential intraday oscillating upward trend. Focus should be on the support level around $5.07.

Nikkei 225:

The Nikkei 225 has closed with consecutive small bullish candlesticks on the daily chart, breaking through previous highs and forming a price gap (vacuum zone). On the 1-hour chart, the price has paused, but the moving averages remain in a bullish divergence pattern. It is highly likely to continue rising in the short term. Intraday focus should be on the support level around 50,280.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live