Plotio

Finance

【Morning session】Hawkish Tilt in Rate Cut Stance Gold Prices Under Pressure

Gold:

On 30 October, the Federal Reserve cut the benchmark interest rate by 25 basis points to 3.75%-4.00%. This is the second rate cut this year, in line with market expectations, and the fifth cut since September 2024.

At the press conference, Powell stated that the rate cuts in September and October were "risk management" cuts, but this will not be the case going forward. In his opening remarks, he noted that there were significant differences among the Committee regarding December’s policy during the meeting, and a rate cut in December is not a foregone conclusion. Subsequently, the market’s implied probability of a Fed rate cut in December dropped rapidly from 85.4% to 67.8%.

Mai Dong, an Investment Strategist at Zhisheng Research(exclusively invited by Plotio), opined that gold’s upward momentum has been suppressed by this development. Meanwhile, senior officials from both sides in the tariff negotiations will hold a meeting soon, which may bring news of tariff delays or even a settlement—also weighing on gold prices.

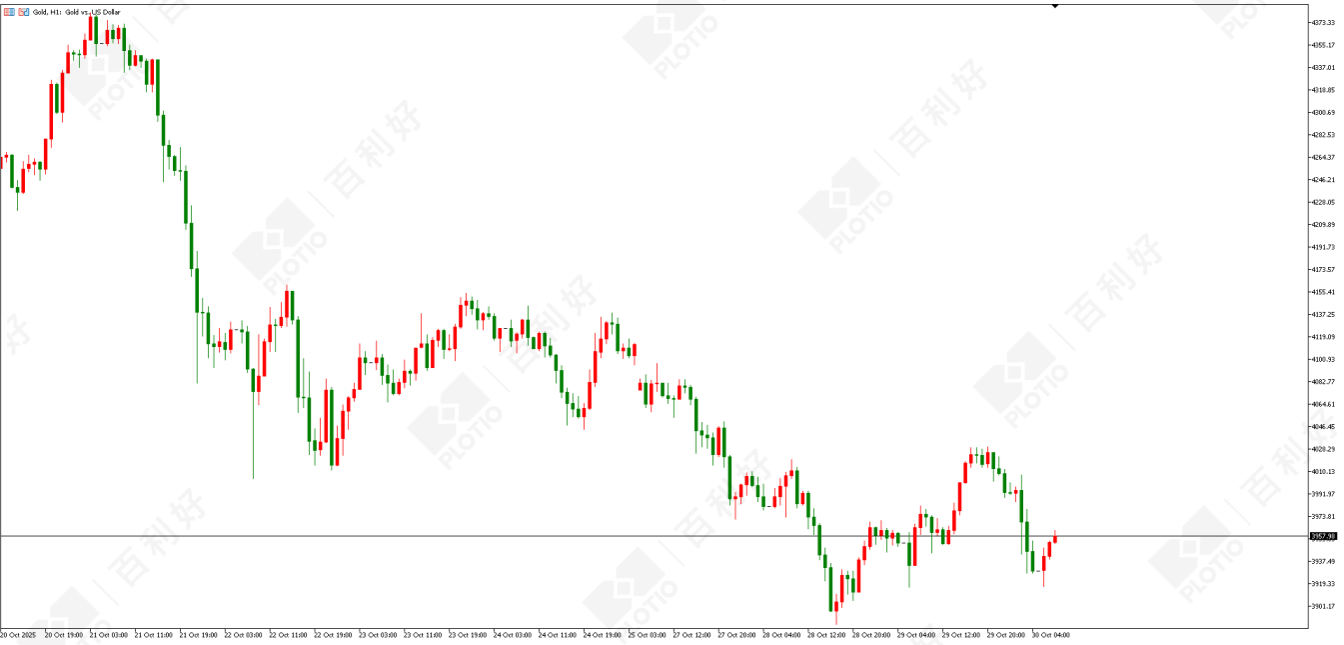

Technical Analysis: On the daily chart, a small bullish candle was closed.From the 1-hour perspective, the price trades below the 120-day moving average, but no new lows have been formed. For today, focus on the support level at $3,920 below and the resistance level at $4,030 above.

Gold hourly chart

Gold hourly chart

Crude Oil:

Crude oil prices have declined consecutively recently, as investors reassess the potential impact of U.S. sanctions on Russia’s oil supply chain.

Last night, the U.S. Energy Information Administration (EIA) released crude oil inventory data for the week ending 24 October: the previous reading showed a decrease of 961,000 barrels, the expected decrease was 211,000 barrels, and the actual reported decrease was 6.858 million barrels.

The unexpected drop in crude oil inventories reflects a slight recovery in regional consumer demand and a modest improvement in overall sentiment in the consumption market. However, against the backdrop of three consecutive months of falling oil prices, investors are more concerned about the global supply remaining in surplus. OPEC+ is set to hold a meeting this weekend, and the market widely expects the group to approve a further production increase plan.

At the same time, trade negotiations between Asian countries and the U.S. remain a key market focus. Currently, the supply side is still bearish; if OPEC+ continues to increase supply, the market will fall deeper into a state of oversupply.

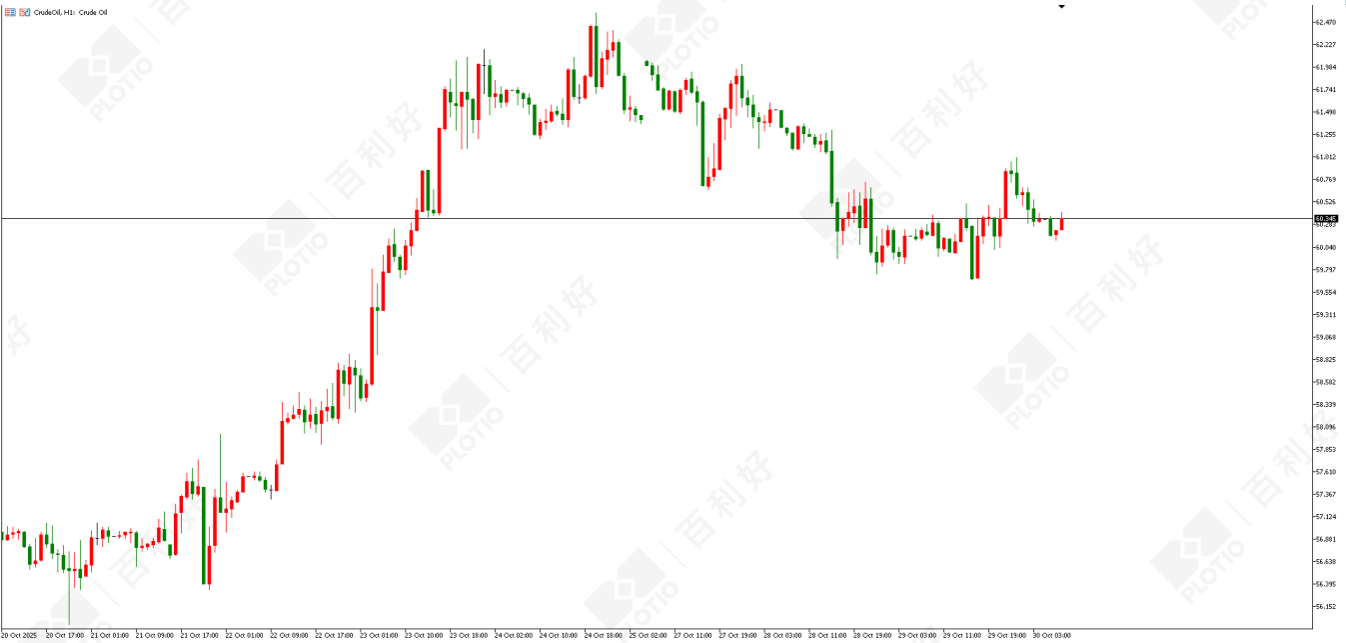

Technical Analysis: On the daily chart, a bullish candle was closed.On the 1-hour timeframe, the price has broken out of consolidation above the 120-day moving average. Intraday focus is on the support level at $59.70 below, the resistance level at $60.90 above, and the strong support at recent lows.

Crude oil hourly chart

Crude oil hourly chart

Copper:

On the daily chart, a bullish candle was closed, with the market stabilizing above $5.10.

On the 1-hour timeframe, the price trades above the 60/120-day moving averages, and the short-term uptrend continues. For today, focus on the support level at $5.11 below and the resistance level at $5.22 above.

Nasdaq:

On the daily chart, a bullish candle was closed, with the price consolidating near historical highs.

From the 1-hour perspective, the price trades above the 60-day moving average, and the market’s uptrend continues. Intraday focus is on the support level at 25,850 below and the resistance level at 26,200 above.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live