Plotio

Finance

【Morning session】Short-Term Feint: Gold Still Set to Rise

Gold:

Overnight, gold saw a short-term flash crash. After hitting a new high around the $4,180 level, it plummeted sharply in the short term, with a maximum pullback of nearly $90. However, it rebounded during the U.S. session and finally closed up 0.77%.

Federal Reserve Chair Jerome Powell paved the way for the central bank to continue cutting interest rates this month. He emphasized that the job market is showing signs of weakness, though concerns about stubborn inflation persist. He also stated that the Fed is trying to balance the two risks and exploring new policy measures to address them.

Peng Cheng, Market Strategist at Zhisheng Research(exclusively invited by Plotio), believes that the U.S. government shutdown has impacted the economy. This will push the Fed to accelerate interest rate cuts to prevent systemic risks, and may even lead to the end of balance sheet reduction.

Technical Analysis: Gold closed with a small bullish candle with a long upper wick on the daily chart. Although bulls still have the upper hand, divergences have emerged. On the 1-hour chart, the low points are moving higher while the high points remain flat, making it highly likely to form a continuation pattern of the uptrend. A new high may be reached during the day. In the short term, focus on support around the $4,135 level, but also be wary of the possibility that the uptrend could end after a new high is set.

Gold hourly chart

Gold hourly chart

Crude Oil:

Overnight, crude oil prices continued to decline slightly, but the pace of decline has slowed significantly. A short-term rebound is possible, though the long-term outlook remains bearish.

Since the start of the year, Brent crude oil futures have plummeted by over 15%, and WTI crude oil futures by over 16%. The crude oil market itself is facing an oversupply dilemma, while growth in demand remains limited. The oversupply contradiction may plague oil prices for a long time.

OPEC+ has agreed to slightly increase crude oil production in November. In November, OPEC+ will add 137,000 barrels per day of crude oil to gradually unwind the 1.65 million barrels per day production cut agreed in April 2023. It is expected to take one year to fully achieve the 1.65 million barrels per day increase.

Based on current crude oil supply and demand data, before the global excess crude oil production capacity is absorbed, the probability of oversupply is very high. It will also take time for international crude oil supply and demand to reach a balance, and there is little hope of resolving this contradiction in the short term.

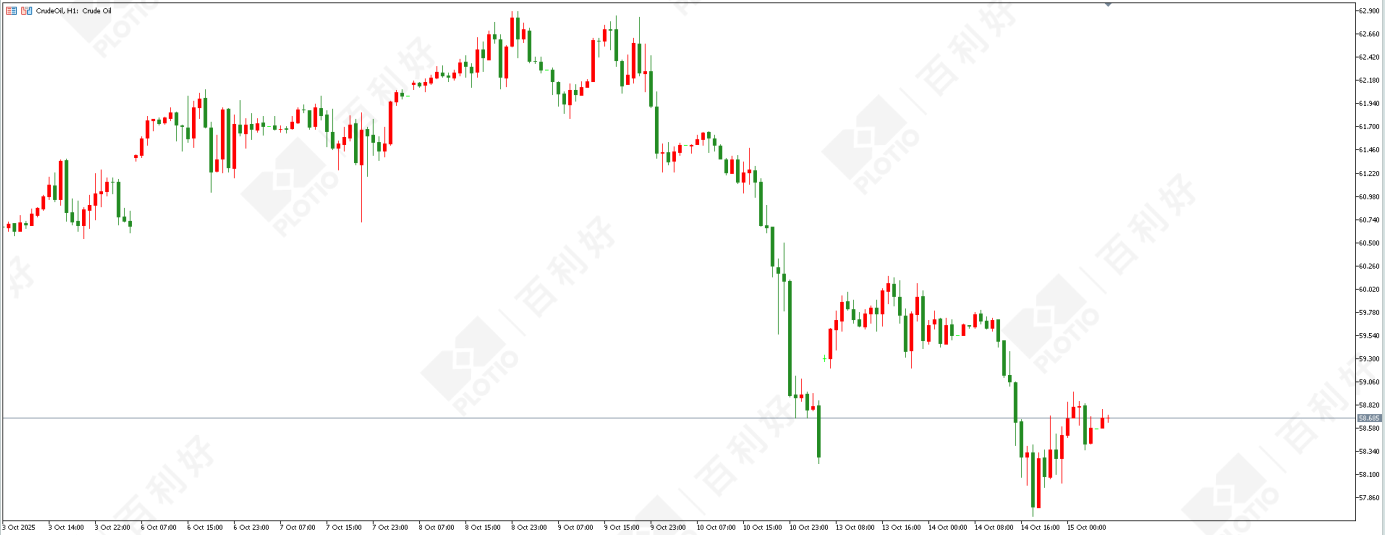

Technical Analysis: Crude oil closed with a small bearish candle on the daily chart, with prices severely oversold and in need of a correction. On the 1-hour chart, the decline has slowed down and there has been a false break to the downside, making a short-term rebound highly likely. If it holds above the $58.20 level during the day, oil prices may rise further.

Crude oil hourly chart

Crude oil hourly chart

Copper:

Copper closed with a large bearish candle on the daily chart, forming a "bearish engulfing" candlestick pattern. The upward structure on the 1-hour chart has been completed, and prices have broken below the long-term moving average. The probability of further decline during the day is high. In the short term, focus on resistance around the $5 level.

Nikkei 225:

The Nikkei 225 has closed with consecutive small bullish candles on the daily chart, which is most likely a correction to the previous large bearish candle. On the 4-hour chart, there is a pullback action from a double top pattern. A short-term decline is highly probable; focus on resistance around the 47,350 level.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live