Plotio

Finance

【Morning Session】Loose conditions are good for gold prices Short-term correction in sight

Gold:

Recent signals from the Federal Reserve have generally leaned toward a dovish stance. Fed Chair Jerome Powell indicated that the central bank is highly likely to conclude its balance sheet reduction within the coming months. Amid mounting downside risks in the U.S. labor market, the Fed is expected to maintain accommodative monetary policies. Additionally, Fed official Richard Boman expressed optimism about implementing two more rate cuts before year-end.

However, the IMF is not pessimistic about the US economy, which it expects to grow 2.0 per cent this year and 2.1 per cent next year, up from its previous forecast of 1.9 per cent and 2.0 per cent.

Chen Yu, senior analyst of Zhisheng Research (exclusively invited by Plotio), said the Fed's loose policy expectations will continue to dominate gold's move, but investors need to be wary of the risk of a pullback from the rally.

Technical Analysis: On the daily chart, the previous trading session saw a bullish candlestick close, indicating strong gold momentum. The 4-hour chart shows prices climbing along the 20-day moving average, with clear bullish signals. Today, watch for support at the $4175 level.

Gold hourly chart

Gold hourly chart

Crude Oil:

the geopolitical uncertainty of the Russia-Ukraine conflict will provide some support for oil prices.

However, fundamental pressures on crude oil fundamentals continue to weigh on oil prices. On the supply side, recent signs of increased production from oil-producing countries are evident: U.S. output has risen to 13.62 million barrels per day, Saudi Arabia's crude oil production has reached a new stage high, Russia's seaborne crude oil exports have climbed to a 28-month peak, and Novak, a Russian energy official, has indicated that Russia has the potential to boost its oil production capacity.

On the demand side, trade frictions between the world's two largest economies have clouded the economic outlook, which is not conducive to improving oil demand. The International Energy Agency (IEA) even expects a bigger glut than previously thought.

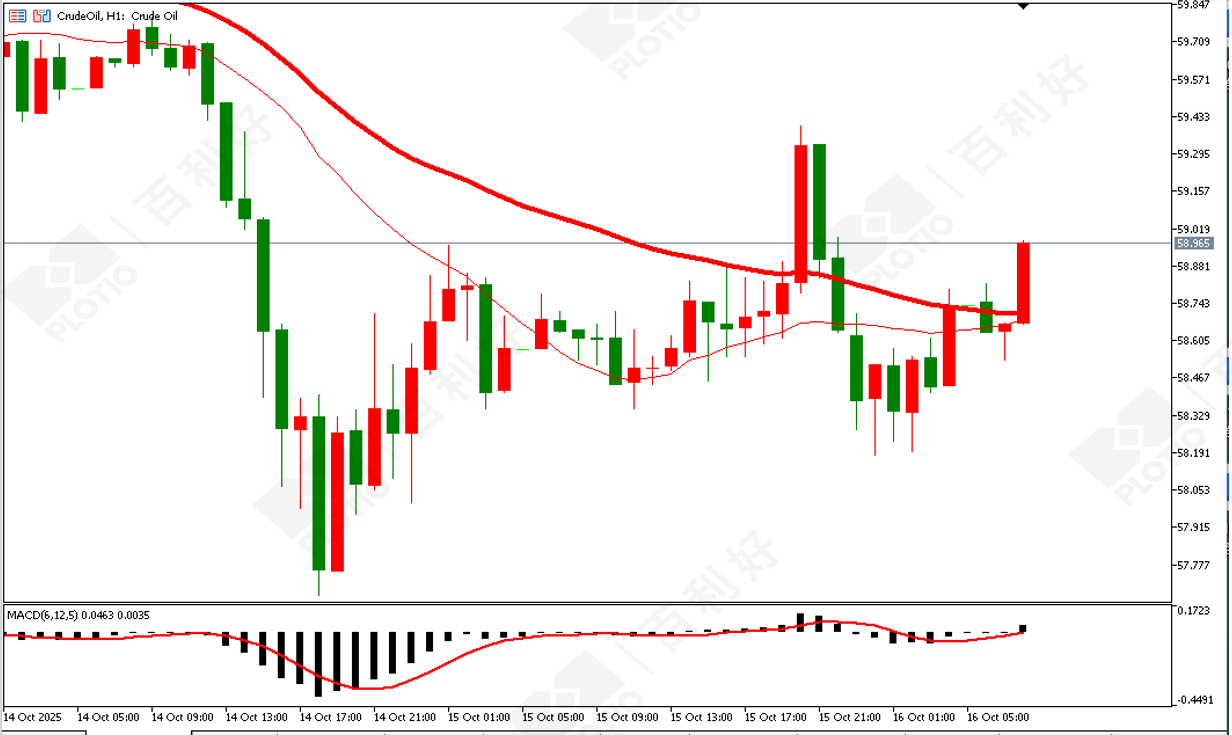

Technical Analysis: On the daily chart, the previous trading session closed with a small bearish candlestick at relatively low levels, indicating continued short-term weakness. Technical indicators show the market currently trading below the 20-day moving average, where bearish forces dominate. Key support lies around $57 while resistance is observed near the $60 level today.

Crude oil hourly chart

Crude oil hourly chart

Copper:

On the daily chart, after a recent surge, the market is now in a phase of high-level correction, with short-term continuation likely. Technical indicators suggest the market is testing the 20-day moving average. Should this level hold, upward momentum could resume. Key watch for today is the $4.85 support zone.

Nikkei 225:

On the daily chart, the recent market pullback tested and found support at the 62-day moving average before resuming its upward trajectory, confirming the bullish trend remains intact. In the short term, watch for support at the 47,228 level during potential pullbacks.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live