Plotio

Finance

【Morning session】Long Term Bullish Factors Bolster Gold Prices Uptrend Unstoppable

Gold:

The U.S. government remains shut down, with continuous layoffs of federal agency employees. Multiple Federal Reserve officials have spoken out; despite differences over the policy path, they generally support another interest rate cut in October.

Overall, China-U.S. trade tensions continue to disrupt the market. However, the main factor driving gold’s sustained rise is the nearly three-year "de-dollarization" trend. Since the Russia-Ukraine war, the U.S. dollar has been on a continuous decline. Meanwhile, under the new administration’s tariff policies, the credibility of the U.S. government has been significantly undermined.

MaiDong, an Investment Strategist at Zhisheng Research(exclusively invited by Plotio), opined that gold prices have recovered the losses from Friday’s decline, and the market remains strong.

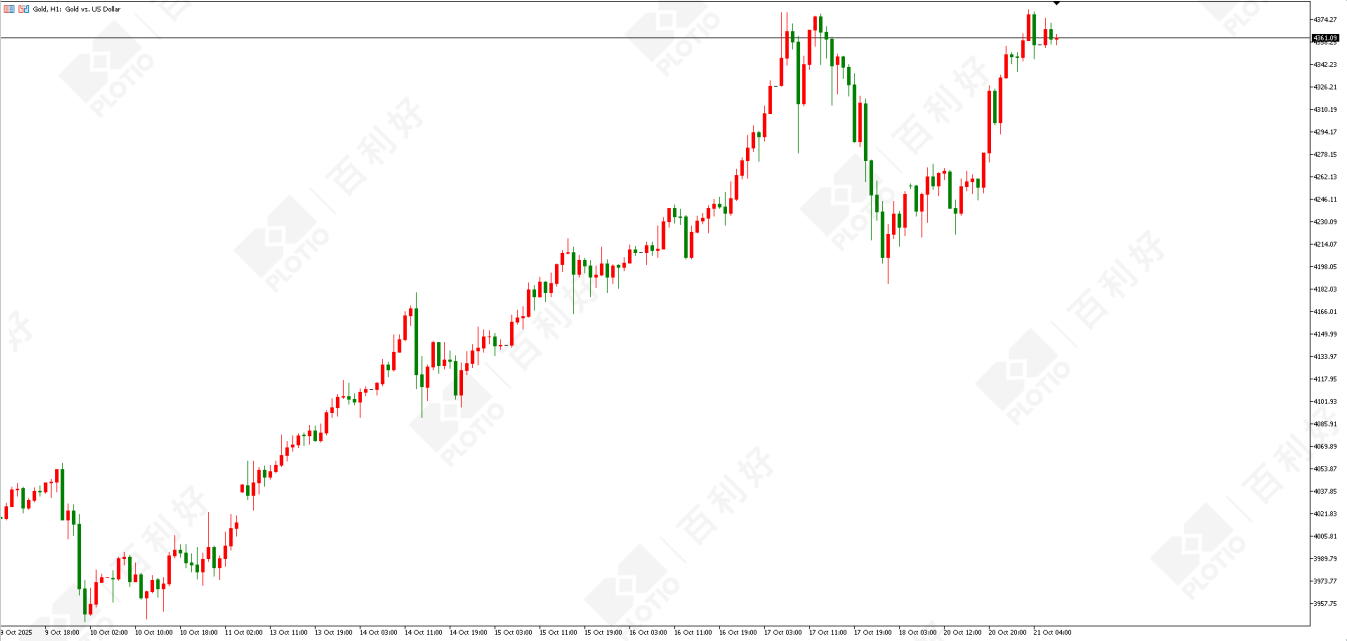

Technical Analysis:On the daily chart, a bearish candle was closed, but the price has the potential to hit a new high.

From the 1-hour perspective, the price trades above the 60/120-day moving averages, and the market remains in an uptrend. The MACD indicator shows that upward momentum is still strong. Intraday focus is on the support level at $4,305 below and the resistance level at $4,400 above.

Gold hourly chart

Gold hourly chart

Crude Oil:

According to market surveys, international energy agencies predict that the global crude oil supply surplus will be higher than previously expected, meaning the pressure of oversupply may further increase.

If the Russia-Ukraine situation eases periodically in winter, oil prices may move toward $50. Of course, there are still risks to energy facilities in some parts of Russia, which may trigger short-term fluctuations, but it is difficult to fundamentally change the supply-demand structure and trend.

From the perspective of energy transition, the continuous advancement of energy transition in emerging economies and European economies has also restrained the overall demand for crude oil. Moreover, Trump’s tariff policies have intensified tensions, further worsening crude oil demand. Multiple factors continue to impact market sentiment, keeping oil prices under downward pressure.

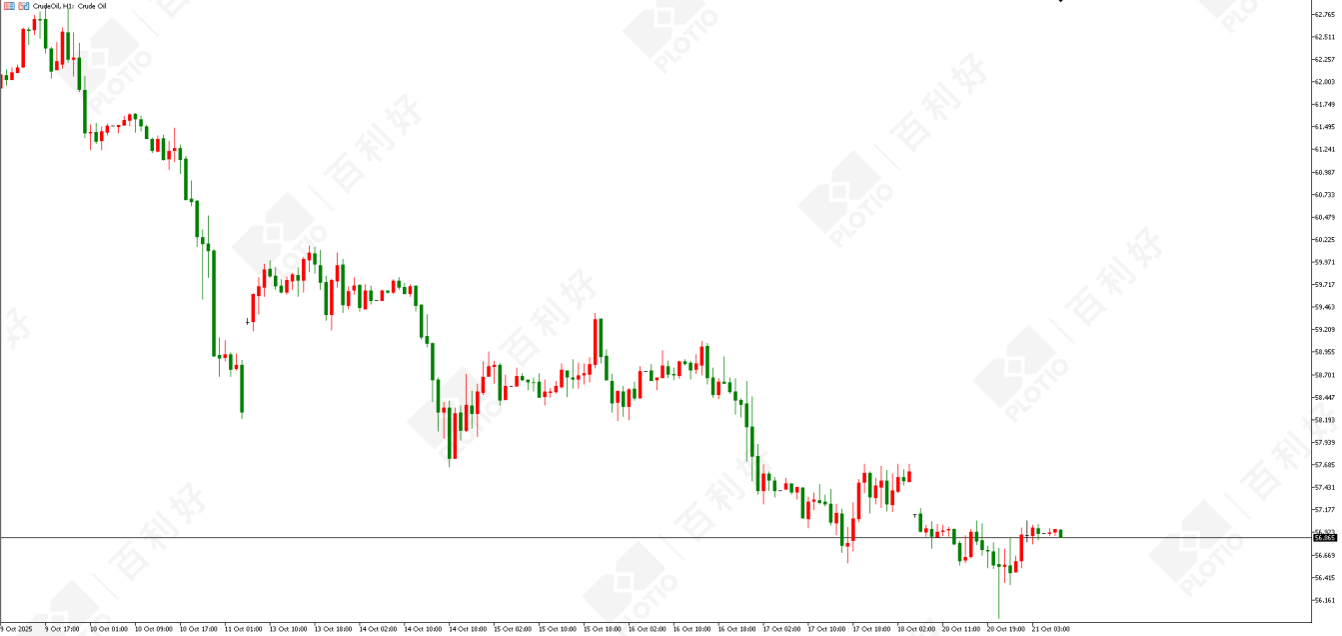

Technical Analysis:On the daily chart, a bearish candle was closed, and the price has declined all the way with no obvious signs of an upward reversal.

On the 1-hour timeframe, the price trades below the 60/120-day moving averages, and the market continues its downtrend. The MACD indicator shows that downward momentum is gradually weakening. Intraday focus is on the support level around $55.10 below, the resistance level around $57.20 above, and the strength of the price in hitting a new low.

Crude oil hourly chart

Crude oil hourly chart

Copper:

On the daily chart, a small bullish candle was closed, and the market remains in a consolidation range of $4.83-$5.10.

On the 1-hour timeframe, the price has broken above the 60/120-day moving averages and trades above them, with the short-term trend shifting upward. Focus on whether the price can stabilize above $5.02 today.

NASDAQ:

On the daily chart, a bullish candle was closed, and the price is approaching its all-time high.

From the 1-hour perspective, the price continues to rise. The key focus today is on the market’s consolidation near the previous high. Intraday focus is on the support level at 25,000 below and the resistance level at 25,250 above.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live