Plotio

Finance

【Morning session】Europe Supports Ceasefire Gold Prices Plummet from Highs

Gold:

On Tuesday, European leaders unexpectedly publicly supported Trump’s proposal to cease fire along the current frontline and launch peace negotiations on this basis, laying the groundwork for peace between Russia and Ukraine.

The statement was released by the UK, with co-signatories including Ukraine, Germany, France, the UK, Italy, and the President of the European Commission. Affected by this, market risk aversion subsided, and gold prices fell sharply.

In the late hours of Monday local time, White House economic adviser Hassett stated that he expected the government shutdown to end this week. Meanwhile, several U.S. banks released relatively optimistic earnings reports, easing market concerns about non-performing loans at U.S. regional banks.

Mai Dong, an investment strategist at Zhisheng Research(exclusively invited by Plotio), opined that as risk aversion cools, prices have pulled back from highs. Judging from the current price performance, the stage-top formation is significant, and prices may fall further.

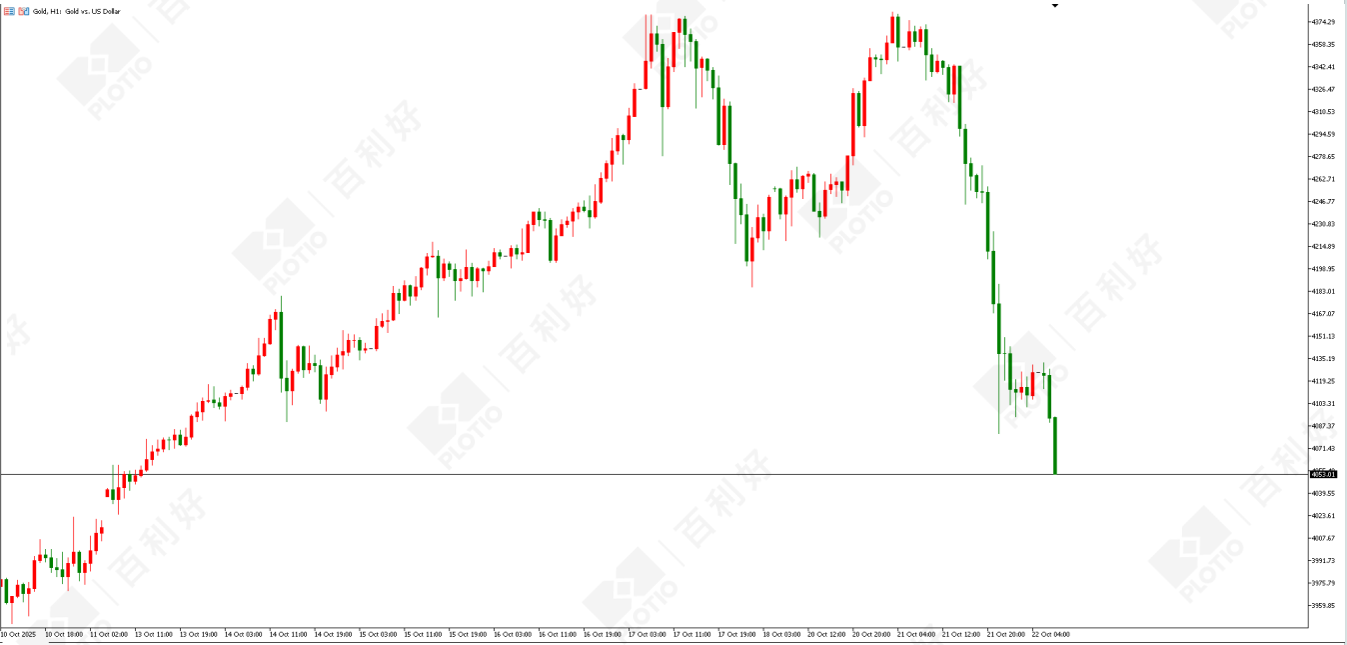

Technical Analysis:On the daily chart, a bearish candle was closed.

From the 1-hour perspective, the price has broken below the 120-day moving average and trades below it, forming a short-term downtrend. Focus on the support level at $4,000 below and the resistance level at $4,160 above.

Gold hourly chart

Gold hourly chart

Crude Oil:

In the late hours of Monday local time, U.S. President Trump stated that regarding tariff issues, he expected a fair trade agreement to be reached next week.

The latest report from the International Energy Agency (IEA) shows that by 2026, the global crude oil market may see a potential supply surplus of approximately 4 million barrels per day, a figure far higher than previous market expectations.

At the same time, the U.S. Energy Information Administration (EIA) raised its forecast for domestic crude oil production and warned that inventory levels have continued to climb recently, indicating that the pressure of oversupply on the supply side has not yet eased.

As the Russia-Ukraine situation may ease and tariff issues may be resolved, bullish and bearish factors in the crude oil market are intertwined, making the future outlook unclear.

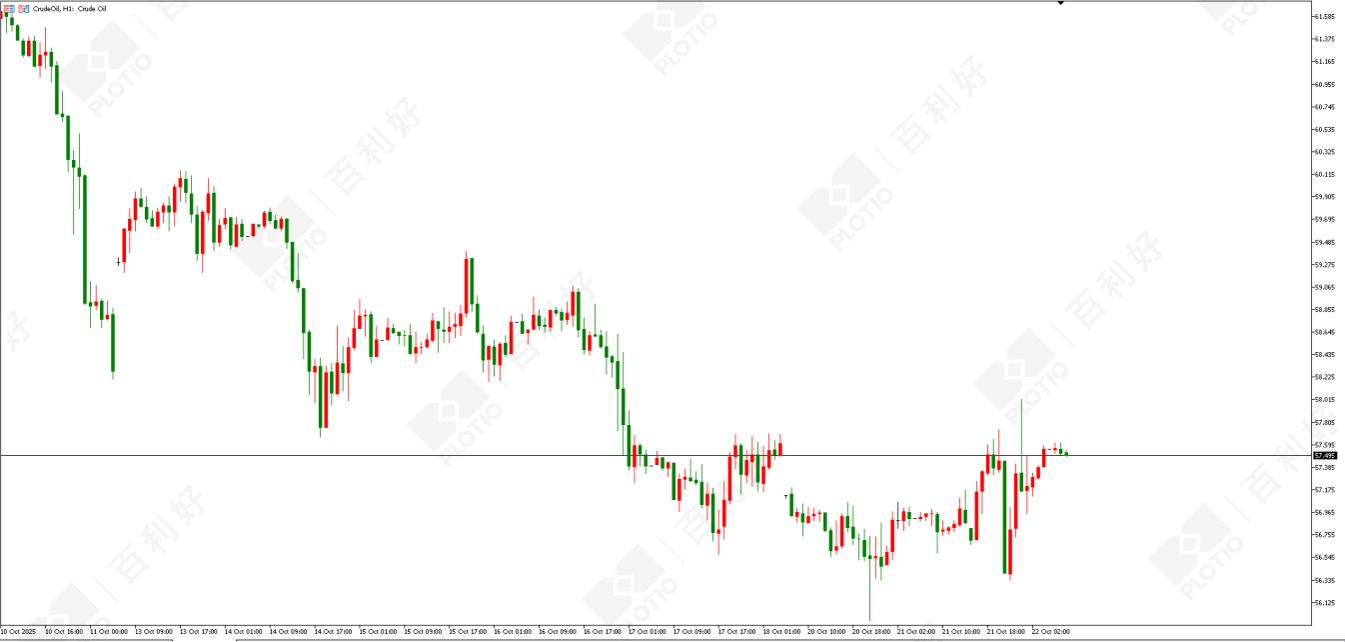

Technical Analysis:On the daily chart, a bullish candle was closed, with prices starting to rebound slightly.

On the 1-hour timeframe, the 60/120-day moving averages tend to flatten, and the price has the potential to break through the 120-day moving average. Combined with the MACD indicating that downward momentum is gradually weakening, the market may reverse direction. Intraday focus is on the support level around $56.70 below, the resistance level around $57.80 above, and whether the price can stabilize above $57.80.

Crude oil hourly chart

Crude oil hourly chart

Copper:

On the daily chart, a bearish candle was closed, and the market remains in a consolidation range of $4.76-$5.10.

On the 1-hour timeframe, the price fluctuates around the 60/120-day moving averages, with the market oscillating in the $4.83-$5.01 range. Focus on whether the price can break out of the range today.

NASDAQ:

On the daily chart, a doji candle was closed, with prices consolidating slightly near historical highs.

From the 1-hour perspective, the price has clearly encountered resistance to upward movement; focus on whether a reversal pattern can form through consolidation. Intraday focus is on the support level at 24,950 below and the resistance level at 25,200 above.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live