Plotio

Finance

【Morning session】U.S.Russia Meeting Cancelled Gold Prices Swing Weakly

Gold:

According to relevant media reports, on 22 October(local time), Trump stated that he believed it was not appropriate to meet with Putin, so he cancelled the meeting with Putin in Budapest.

Trump said that his conversations with Putin had been very pleasant each time, but no substantive progress had been made, and he believed that meetings would still be held in the future.

Compared with the previous upward trend, this round of decline is still a corrective pullback, but the adjustment range has exceeded expectations. Looking ahead, if the gold price falls below $4,000, it may face a larger-scale sell-off. However, central banks around the world have continued to purchase gold in recent years, and the fundamental logic driving de-dollarization may limit the decline.

Mai Dong, an investment strategist at Zhisheng Research(exclusively invited by Plotio), opined that affected by the sharp drop, prices are declining slowly; in the near term, the market tends to consolidate weakly.

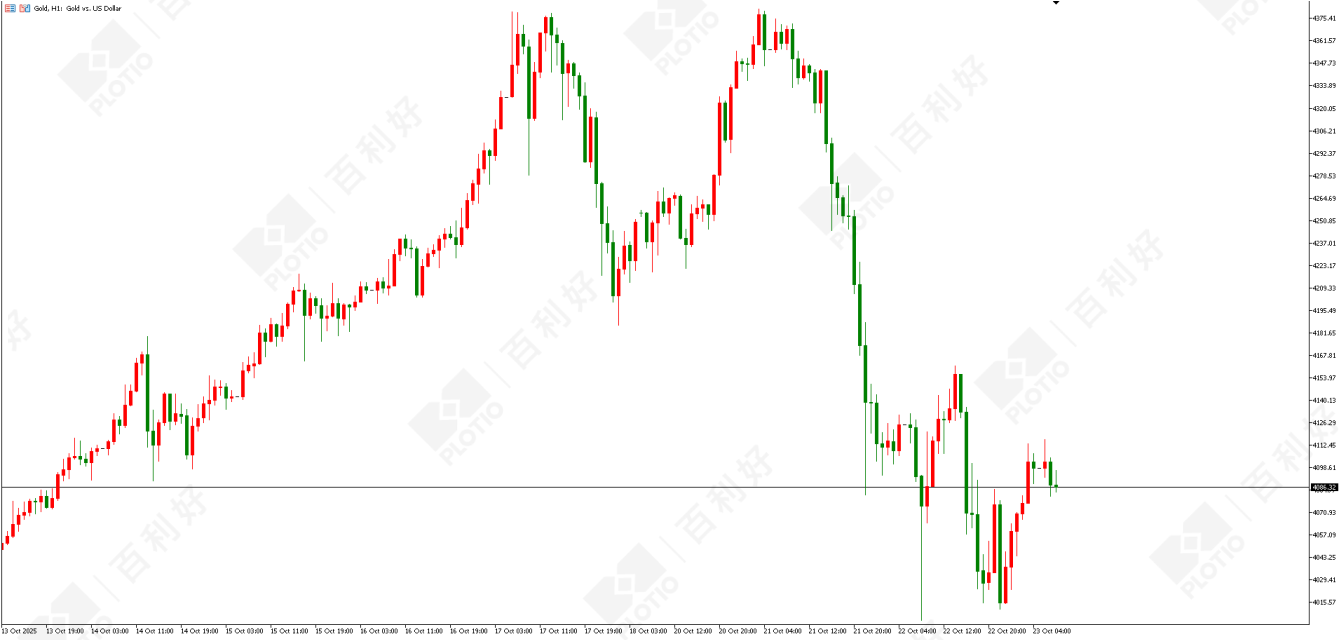

Technical Analysis:On the daily chart, a bearish candle was closed, with the price touching $4,002 in the short term.From the 1-hour perspective, the short-term downtrend continues, and the price trades below the 120-day moving average. Focus on the support level at $4,010 below and the resistance level at $4,150 above.

Gold hourly chart

Gold hourly chart

Crude Oil:

Recently, Trump stated that high tariffs are unsustainable and that he is willing to promote the improvement of relations with major Asian countries. As a result, market concerns about tariffs will ease, boosting confidence in the crude oil market. At the same time, U.S. fiscal officials are about to meet with the team from the major Asian country, and the market expects to see easing signals in the coming weeks.

Data from the U.S. EIA showed that inventories fell by 961,000 barrels in the week, compared with an increase of 3.524 million barrels in the previous week. The improvement in the crude oil consumption market has warmed up market sentiment toward the demand side.

However, OPEC+ insists on its production increase plan, and medium-to-long-term supply pressure will limit the upside space of crude oil. The IEA also expects a crude oil surplus in the future, which may suppress the upside potential of oil prices.

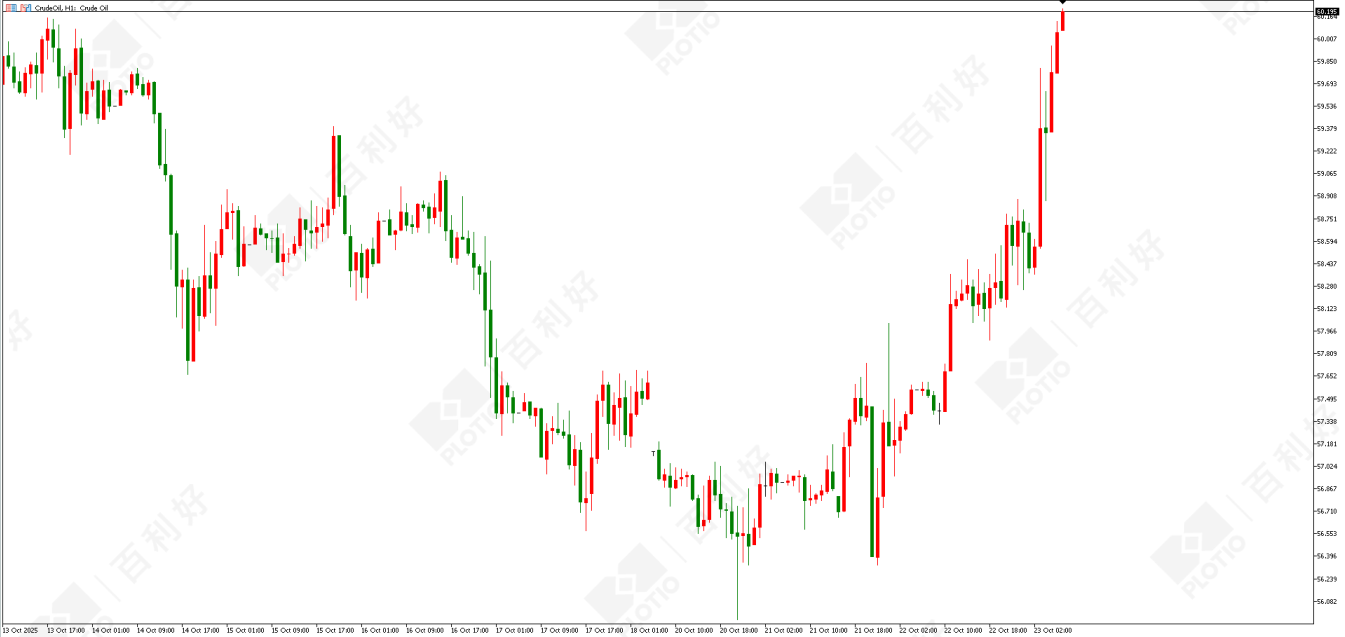

Technical Analysis:On the daily chart, a bullish candle was closed, and prices have started a slight rebound.On the 1-hour timeframe, the price has broken through the 60/120-day moving averages and trades above them. From the MACD perspective, the momentum bars show an expanding trend, with bulls starting to gain strength; the short-term market has turned bullish. Prices may continue to rise. Focus on the support level at $59.10 below and the resistance level around $61.70 above.

Crude oil hourly chart

Crude oil hourly chart

Copper:

On the daily chart, a small bullish candle was closed, and the market remains in a consolidation range of $4.76-$5.10.

On the 1-hour time frame, the market is oscillating, and the effectiveness of moving averages has weakened. Currently, it is still oscillating in the $4.83-$5.01 range; focus on whether the price can break out of the range.

NASDAQ:

On the daily chart, a bearish candle was closed, and the price continues to consolidate at a high level in the 24,000-25,200 range.

From the 1-hour perspective, the price has broken through the 60/120-day moving averages and trades below them, forming a short-term downtrend. Intraday focus is on the support level at 24,500 below and the resistance level at 24,970 above.

[Important Disclaimer:The above content and views are provided by Zhisheng, a third-party cooperative platform, for reference only and do not constitute any investment advice. Investors who trade based on this information shall bear their own risks.]

In the event of any inconsistency between the English and Chinese versions, the Chinese version will prevail.This article is from Plotio. Please indicate the source when reprinting.

Download APP

Download APP

ZhiSheng Live

ZhiSheng Live